Global Inulinase Market to Surpass USD 1,613.8 Million by 2034, Driven by 4.9% CAGR and Expanding Applications in Food, Beverages, and Dietary Supplements | Future Market Insights, Inc.

The Inulinase Market is an ever-evolving industry that has seen a significant shift in the past decade. To gain a better understanding of the Inulinase market, it’s important to analyze both the historical outlook and future projections. Historical data helps provide insight into current trends, while future projections can help anticipate changes and prepare for them accordingly.

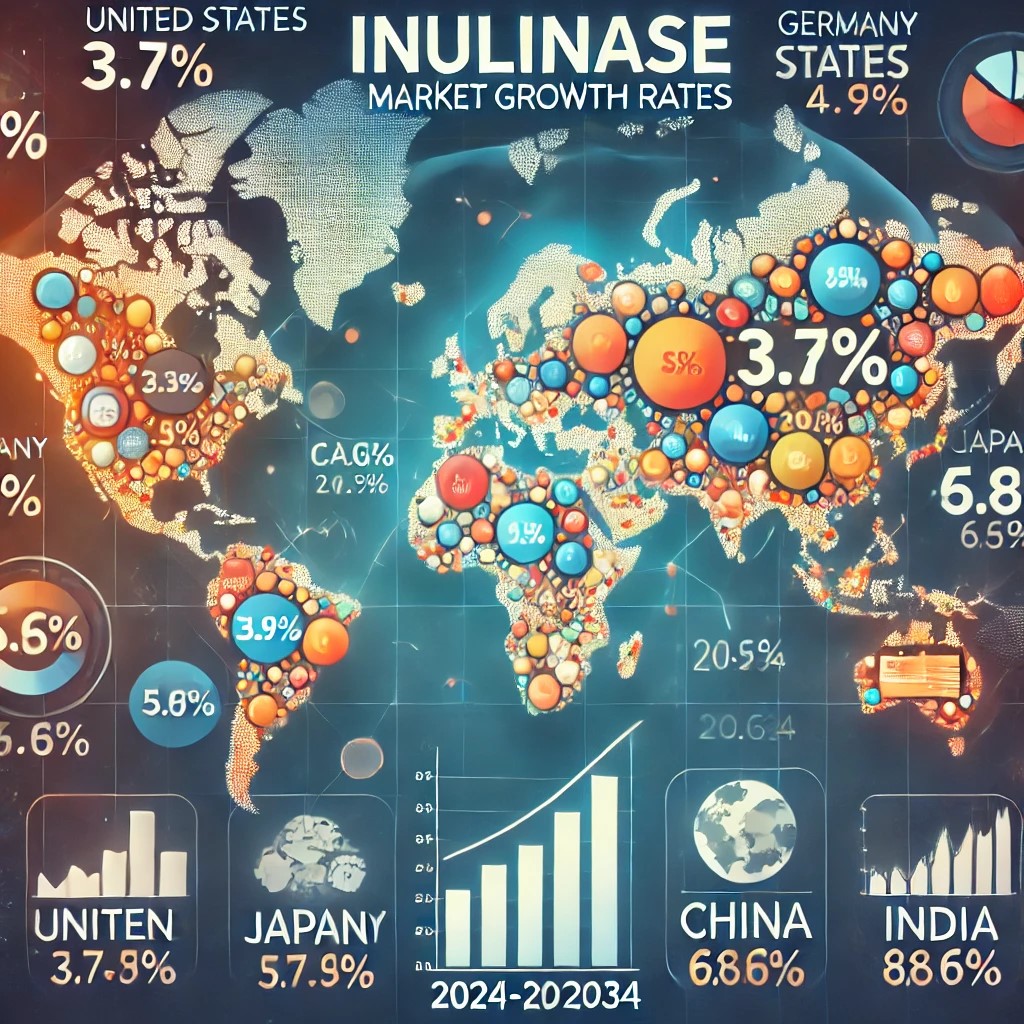

/EIN News/ -- NEWARK, Del, Jan. 07, 2025 (GLOBE NEWSWIRE) -- The global Inulinase industry sales reached approximately USD 1,083.1 million at the end of 2024. Forecasts indicate that the market will grow at a compound annual growth rate (CAGR) of 4.9%, potentially exceeding USD 1,613.8 million in value by 2034. This steady growth trajectory is driven by the enzyme’s expanding applications across diverse industries, including food and beverages, dietary supplements, and animal feed, as well as rising consumer awareness about health and sustainability.

Inulinase is an enzyme with widespread use in various sectors such as food products, beverages, dietary supplements, and animal feed. The growing consumer focus on health and wellness has significantly boosted the demand for dietary supplements enriched with enzymes like inulinase. This trend is particularly pronounced in the food and beverage industry, where inulinase enhances product quality and efficiency, addressing the increasing demand for natural, high-quality ingredients with extended shelf lives.

In the animal feed sector, inulinase plays a vital role in improving livestock performance and immunity. By facilitating better digestion, the enzyme not only enhances the health of animals but also reduces waste heaps, contributing to environmental sustainability and lowering feed management costs. These attributes make inulinase an essential component in addressing global challenges related to food quality and agricultural efficiency.

Inulinase is a key enzyme used in several industrial products. The global Inulinase market has been growing steadily in recent years, due to its increasing demand from application areas such as food and beverages, pharmaceuticals, and biotechnology.

Market Drivers and Challenges

Growth Drivers:

- Consumer Health Consciousness: Rising awareness about healthy living has fueled the demand for enzyme-based dietary supplements and natural food additives. Inulinase’s role in improving digestion and nutritional value positions it as a preferred choice in health-focused markets.

- Technological Advancements: Innovations in enzyme production technologies have led to more efficient and specific inulinase products. Biotechnological breakthroughs continue to drive the development of advanced enzymes, expanding their applications in diverse industries.

-

Sustainability Initiatives: The enzyme’s role in reducing environmental pollution through waste minimization and its ability to enhance the efficiency of animal feed aligns with global sustainability goals, further propelling its adoption.

- Cost Constraints: The production of inulinase involves complex biotechnological processes, which can lead to higher manufacturing costs and impact its affordability.

- Regulatory Hurdles: Stringent regulations regarding enzyme usage in food and feed industries may pose challenges to market players, especially in regions with rigorous compliance requirements.

-

Market Fragmentation: Despite its wide-ranging applications, the inulinase market remains fragmented, with competition from alternative enzyme solutions.

Industry Highlights

- Diverse Applications: Inulinase’s ability to cater to various industries, from baking and dairy to beverages and desserts, underscores its versatility. The enzyme’s utility in improving texture, taste, and nutritional profiles of products continues to drive its demand.

- Innovative Developments: Ongoing research and development efforts are yielding innovative enzyme products that offer higher efficiency and specificity, enabling manufacturers to meet evolving consumer preferences.

-

Global Adoption: With growing awareness about environmental sustainability, the use of inulinase in animal feed has gained traction globally, particularly in regions focusing on eco-friendly agricultural practices.

“The global inulinase market is on an impressive growth trajectory, driven by increasing consumer preference for natural and health-centric products. The enzyme’s ability to enhance food quality and sustainability makes it an indispensable asset in today’s health-conscious and environmentally aware society. However, to fully capitalize on this potential, industry players must address cost and regulatory challenges through innovation and strategic collaboration.” says Nandini Roy Choudhury, Client Partner at Future Market Insights.

Category-wise Insights

What are the various uses of Inulinase in the food industry?

Inulinase can be applied during production to add sweetness without calories or added sugars. It also helps reduce bitterness in certain foods such as coffee and cocoa-based products. Other applications include producing low-fat dairy products like yogurt and cheese with improved texture, taste, and mouthfeel. Additionally, it can help stabilize processed foods by reducing their viscosity, allowing for a more consistent shelf life and product quality over time.

What is the most important use of Inulinase?

Inulinase is most commonly used to break down complex carbohydrates, such as starches and fiber, into simple sugars. This makes it one of the most important enzymes used in high fructose syrup production. High fructose syrup is produced by breaking down a variety of carbohydrates, including sucrose and starch, with Inulinase.

What is plant Inulinase?

Plant Inulinase is an enzyme produced naturally by plants that break down a type of carbohydrate known as inulin. Inulin is a complex, non-digestible form of natural sugar found in many plants such as onions, garlic, and bananas. This enzyme allows the plant to break down the inulin into its component sugars so that it can be used for energy by both humans and animals.

Country-wise Insights

The table below highlights revenue from product sales in key countries. The United States and China are predicted to remain top consumers, with estimated valuations of USD 361.3 Million and USD 283.4 Million, respectively, by 2034.

| Countries | Value (2034) |

| United States | USD 361.3 Million |

| Germany | USD 258.4 Million |

| Japan | USD 98.1 Million |

| China | USD 283.4 Million |

| India | USD 160.6 Million |

The Role of Inulinase Across Industries in the United States

The Role of Inulinase Across Industries in the United States

The market for inulinase in the United States is anticipated to grow at a compound annual growth rate (CAGR) of 3.7% during the forecast period, reaching a revenue of USD 361.3 million by 2034.

This growth is fueled by the increasing use of inulinase as a bakery enzyme, which aligns with consumer preferences for convenient and health-focused food products. Despite the rising cost of some baking products, the demand for inulinase remains robust, particularly within the household consumer segment.

Germany: A Key Market for Inulinase in Europe

Increased demand for animal products in Germany is driving a significant rise in inulinase usage. The German inulinase market is projected to grow at a value CAGR of 4.7% from 2024 to 2034, reaching a market value of USD 258.4 million by the end of the forecast period.

Germany's growing livestock sector has heightened the need for advanced feed enzymes to improve yield, feed conversion ratios, and protein output in industrial-scale production. As the country invests in modernizing its agricultural infrastructure, high-quality inulinase feed enzymes are becoming essential for enhancing compound feed production.

India’s Expanding Inulinase Market Fueled by Feed Enzymes

India's inulinase market is poised for rapid growth, with an expected value CAGR of 10.6% over the next decade. By 2034, the market size is forecasted to reach USD 6.5 million, accounting for 27.5% of South Asia’s inulinase market share.

Explore the full report for expert analysis. https://www.futuremarketinsights.com/reports/inulinase-market

Leading Inulinase Brands

- Jarrow Formulas

- Sensus

- BENEO

- Cosucra

- Orafti

- Kikkoman Corporation

- Triveni Formulations Limited

- Nutrients India Private Limited

- Bioven Ingredients

- Alfa Chemistry

Key Segments of Market Report

By Product Type:

By Product Type, the segment has been categorized into Plant Inulinase and microbial Inulinase.

By Application:

Different Applications included Bioethanol Production, High Fructose Syrup, Inula-oligosaccharides Production, and Other Applications.

By Region:

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Spanish Translation

Las ventas mundiales de la industria de la inulinasa alcanzaron aproximadamente los 1.083,1 millones de dólares a finales de 2024. Las previsiones indican que el mercado crecerá a una tasa de crecimiento anual compuesta (CAGR) del 4,9%, superando potencialmente los 1.613,8 millones de dólares en valor para 2034. Esta trayectoria de crecimiento constante está impulsada por la expansión de las aplicaciones de la enzima en diversas industrias, incluidos alimentos y bebidas, suplementos dietéticos y alimentos para animales, así como por la creciente conciencia de los consumidores sobre la salud y la sostenibilidad.

La inulinasa es una enzima de uso generalizado en diversos sectores, como productos alimenticios, bebidas, suplementos dietéticos y alimentos para animales. El creciente interés de los consumidores por la salud y el bienestar ha impulsado significativamente la demanda de suplementos dietéticos enriquecidos con enzimas como la inulinasa. Esta tendencia es particularmente pronunciada en la industria de alimentos y bebidas, donde la inulinasa mejora la calidad y la eficiencia del producto, abordando la creciente demanda de ingredientes naturales de alta calidad con una vida útil prolongada.

En el sector de la alimentación animal, la inulinasa desempeña un papel vital en la mejora del rendimiento y la inmunidad del ganado. Al facilitar una mejor digestión, la enzima no solo mejora la salud de los animales, sino que también reduce los montones de desechos, contribuyendo a la sostenibilidad ambiental y reduciendo los costos de manejo de alimentos. Estos atributos hacen de la inulinasa un componente esencial para abordar los desafíos globales relacionados con la calidad de los alimentos y la eficiencia agrícola.

Impulsores y desafíos del mercado

Impulsores de crecimiento:

1. Conciencia de la salud del consumidor: La creciente conciencia sobre una vida saludable ha impulsado la demanda de suplementos dietéticos a base de enzimas y aditivos alimentarios naturales. El papel de la inulinasa en la mejora de la digestión y el valor nutricional la posiciona como la opción preferida en los mercados centrados en la salud.

2. Avances tecnológicos: Las innovaciones en las tecnologías de producción de enzimas han dado lugar a productos de inulinasa más eficientes y específicos. Los avances biotecnológicos continúan impulsando el desarrollo de enzimas avanzadas, ampliando sus aplicaciones en diversas industrias.

3. Iniciativas de sostenibilidad: El papel de la enzima en la reducción de la contaminación ambiental a través de la minimización de residuos y su capacidad para mejorar la eficiencia de la alimentación animal se alinea con los objetivos globales de sostenibilidad, impulsando aún más su adopción.

Desafíos de la industria:

1. Restricciones de costos: La producción de inulinasa implica procesos biotecnológicos complejos, que pueden conducir a costos de fabricación más altos e impactar su asequibilidad.

2. Obstáculos regulatorios: Las regulaciones estrictas con respecto al uso de enzimas en las industrias de alimentos y piensos pueden plantear desafíos para los actores del mercado, especialmente en regiones con rigurosos requisitos de cumplimiento.

3. Fragmentación del mercado: A pesar de su amplia gama de aplicaciones, el mercado de la inulinasa sigue estando fragmentado, con la competencia de soluciones enzimáticas alternativas.

Aspectos destacados de la industria

1. Diversas aplicaciones: La capacidad de la inulinase para atender a diversas industrias, desde la panadería y los productos lácteos hasta las bebidas y los postres, subraya su versatilidad. La utilidad de la enzima para mejorar la textura, el sabor y los perfiles nutricionales de los productos sigue impulsando su demanda.

2. Desarrollos innovadores: Los esfuerzos continuos de investigación y desarrollo están produciendo productos enzimáticos innovadores que ofrecen una mayor eficiencia y especificidad, lo que permite a los fabricantes satisfacer las preferencias cambiantes de los consumidores.

3. Adopción global: Con la creciente conciencia sobre la sostenibilidad ambiental, el uso de inulinasa en la alimentación animal ha ganado terreno a nivel mundial, particularmente en regiones que se centran en prácticas agrícolas ecológicas.

"El mercado mundial de la inulinasa se encuentra en una trayectoria de crecimiento impresionante, impulsada por la creciente preferencia de los consumidores por productos naturales y centrados en la salud. La capacidad de la enzima para mejorar la calidad y la sostenibilidad de los alimentos la convierte en un activo indispensable en la sociedad actual, consciente de la salud y el medio ambiente. Sin embargo, para capitalizar completamente este potencial, los actores de la industria deben abordar los desafíos regulatorios y de costos a través de la innovación y la colaboración estratégica", dice Nandini Roy Choudhury, socio de clientes de Future Market Insights.

Perspectivas por país

En la siguiente tabla se destacan los ingresos procedentes de las ventas de productos en los principales países. Se prevé que Estados Unidos y China sigan siendo los principales consumidores, con valoraciones estimadas de 361,3 millones de dólares y 283,4 millones de dólares, respectivamente, para 2034.

| Países | Valor (2034) |

| Estados Unidos | USD 361,3 millones |

| Alemania | USD 258,4 millones |

| Japón | USD 98,1 millones |

| China | USD 283,4 millones |

| India | USD 160,6 millones |

El papel de la inulinasa en todas las industrias de los Estados Unidos

Se prevé que el mercado de inulinasa en los Estados Unidos crezca a una tasa de crecimiento anual compuesta (CAGR) del 3,7 % durante el período de pronóstico, alcanzando unos ingresos de USD 361,3 millones para 2034.

Este crecimiento está impulsado por el uso cada vez mayor de la inulinasa como enzima de panadería, que se alinea con las preferencias de los consumidores por productos alimenticios convenientes y centrados en la salud. A pesar del aumento del costo de algunos productos de panadería, la demanda de inulinasa sigue siendo sólida, particularmente en el segmento de consumidores domésticos.

Alemania: un mercado clave para la inulinasa en Europa

El aumento de la demanda de productos animales en Alemania está impulsando un aumento significativo en el uso de inulinasa. Se proyecta que el mercado alemán de inulinasa crezca a una CAGR de valor del 4,7 % de 2024 a 2034, alcanzando un valor de mercado de USD 258,4 millones al final del período de pronóstico.

El creciente sector ganadero de Alemania ha aumentado la necesidad de enzimas alimentarias avanzadas para mejorar el rendimiento, los índices de conversión alimenticia y la producción de proteínas en la producción a escala industrial. A medida que el país invierte en la modernización de su infraestructura agrícola, las enzimas de inulinasa de alta calidad para piensos se están volviendo esenciales para mejorar la producción de piensos compuestos.

El mercado en expansión de la inulinasa de la India impulsado por las enzimas de los piensos

El mercado de inulinasa de la India está preparado para un rápido crecimiento, con una CAGR de valor esperado del 10,6% durante la próxima década. Para 2034, se prevé que el tamaño del mercado alcance los 6,5 millones de dólares, lo que representa el 27,5% de la cuota de mercado de la inulinasa del sur de Asia.

Marcas líderes de inulinasa

- Fórmulas de Jarrow

- Sensus

- BENEO

- Cosucra

- Orafti

- Corporación Kikkoman

- Formulaciones Triveni Limitadas

- Nutrientes India Limitada Privada

- Ingredientes de Bioven

- Alfa Química

Informe de segmentos clave del mercado

Por tipo de producto:

Por tipo de producto, el segmento se ha clasificado en inulinasa vegetal e inulinasa microbiana.

Por aplicación:

Las diferentes aplicaciones incluyeron la producción de bioetanol, jarabe de alta fructosa, producción de inula-oligosacáridos y otras aplicaciones.

Por región:

El análisis de la industria se ha llevado a cabo en países clave de América del Norte, América Latina, Europa, Asia Oriental, Asia Meridional, Oceanía y Medio Oriente y África.

Authored by:

Nandini Roy Choudhury (Client Partner for Food & Beverages at Future Market Insights, Inc.) has 7+ years of management consulting experience. She advises industry leaders and explores off-the-eye opportunities and challenges. She puts processes and operating models in place to support their business objectives.

She has exceptional analytical skills and often brings thought leadership to the table.

Nandini has vast functional expertise in key niches, including but not limited to food ingredients, nutrition & health solutions, animal nutrition, and marine nutrients. She is also well-versed in the pharmaceuticals, biotechnology, retail, and chemical sectors, where she advises market participants to develop methodologies and strategies that deliver results.

Her core expertise lies in corporate growth strategy, sales and marketing effectiveness, acquisitions and post-merger integration and cost reduction. Nandini has an MBA in Finance from MIT School of Business. She also holds a Bachelor’s Degree in Electrical Engineering from Nagpur University, India.

Nandini has authored several publications, and quoted in journals including Beverage Industry, Bloomberg, and Wine Industry Advisor.

Explore FMI’s related ongoing Coverage in the Food and Beverage Domain:

The global inulin market size is estimated to reach USD 1,678.9 million in 2023. Demand for inulin is expected to rise at a CAGR of 3.4% during the assessment period. By 2033, the global market for inulin is projected to reach a valuation of USD 2,345 million.

According to Future Market Insights research, during the projected forecast period, the Agave Inulin market is expected to grow at a CAGR of 4.6%. The market value projected to increase is from USD 2,225.4 Million in 2022 to USD 3,489.2 Million by 2032.

According to Future Market Insights (FMI), the global dietary supplement market is projected to reach a value of USD 74.3 billion in 2024 and is expected to grow to USD 170.1 billion by 2034.

The herbal supplement market is capable of accumulating USD 93,886.3 million in revenues in 2024. As the appeal of natural or plant-based supplements has increased substantially recently, the overall market is set to experience a year-on-year growth of 7.6% during the forecast period.

The global probiotic supplement market size is expected to reach USD 7,524.6 million in 2024. It is projected to exhibit steady growth during the forecast period, with global demand for probiotic supplements rising at 11.2% CAGR.

The global digestive health supplements market size is estimated to reach USD 17,160 million in 2023. With demand expanding at a 6% CAGR, the market size is projected to reach USD 29,648.6 million over the forecast period.

The multi nutritional supplement market was worth USD 310 Billion in 2020 and is expected to advance at a 5.9% CAGR from 2022 to 2032.

Postnatal Health Supplements Market is expected to have generated USD 2.79 billion by 2023, along with a CAGR of 7.2% from 2023 to 2033.

The overall demand for green supplements is projected to grow at a CAGR of 3.8 %, reaching around USD 818.0 Million by 2032.

The global Protein Supplement Market size is projected to surpass a valuation of USD 62,990 million by 2033. Our food and beverage analysts opine that protein supplement manufacturers can expect a stunning CAGR of 8.5% through 2033.

Check Our Latest Article on Food Coating Materials Market: Meeting the Needs of Modern Cuisine and Sustainability

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Join us as we commemorate 10 years of delivering trusted market insights. Reflecting on a decade of achievements, we continue to lead with integrity, innovation, and expertise.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

Distribution channels: Book Publishing Industry ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release